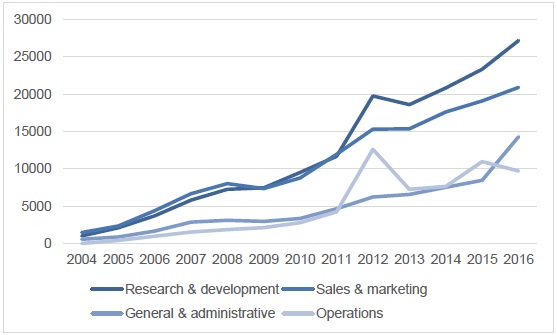

Figure 1:

Labour power

breakdown (2004 - 2016)

The

above

figure shows the change in the structure of labour power between 2004

and 2016

(Source: Author’s analysis

based on

Form 10-Ks). At the time of the IPO, the company structure was

the

following: 1,003 employees in research and development; 1,463 in sales

and

marketing; 555 general and administrative staff and no recorded staff in

operations.[14]

The fact that the number of sales and marketing staff outnumbered

research and

development (R&D) staff shows how, at that time, the company needed

to find

profitable business models for its search engine algorithms. The key was

attracting advertising investments. The number of R&D staff compared

to

sales and marketing staff was relatively equal until 2012. In August

2011,

Google made one of its biggest acquisitions by purchasing Motorola

Mobility

Holdings Inc. for a reported 12.6 billion USD.[15]

The

Motorola operating results and staff (16,317) were incorporated into

Google’s

2012 market results, displayed as a significant increase in the

headcount of

R&D and operations staff.[16]

The

purchase was made for at least three different reasons. First, to

increase the

highly skilled labour power. Second, to obtain a large number of

intellectual

property rights, especially patents owned by Motorola. And third, to

expand

into the rising mobile telephone market, update Google’s Android OS and

mobile

search services, and increase capital accumulation. Since 2012 R&D

staff

continues to outnumber other organisational staff. In 2016, the R&D

staff

count was 27,169, followed by sales and marketing with 20,902, general

and

administrative with 14,287 and operations with 9,695.[17]

The high

numbers of R&D staff established show the need to stay on top of

technological developments in the digital industry. While early market

reports

in the mid-2000s explicitly emphasised keeping up with technological

changes,

the more recent reports reflect the company’s dominant position in

defining and

promoting new technological trends, most prominently artificial

intelligence

and machine learning. Attracting computer scientists and engineers from

leading

technical universities is one of the key corporate strategies for

sustaining its

globally dominant position.

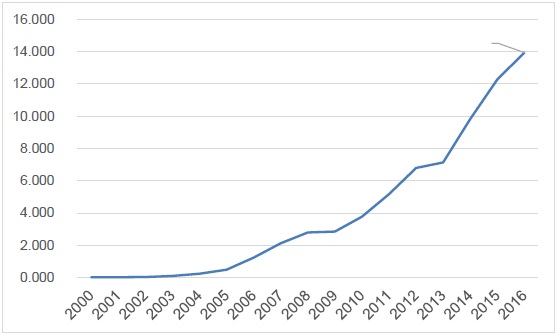

Figure 2: R&D spending (2000-2016) in billion USD

The

company

also maintains its global dominance through strategic acquisitions[18]

and substantial internal R&D investments. In 2016, the total R&D

costs

were 13,948 billion USD (see Figure 2 [source: author’s analysis based

on Form

10-Ks]). The main costs of R&D include compensation and related

costs for

personnel responsible for the research and development of new products

and

services, as well as significant improvements to existing products and

services. The outward image Google promotes is a well-known dimension of

workplace creativity and innovation. This forms an integral part of the

organisational

rationality included in every market report since 2004. It serves to

solidify

the image of the ‘non-conventional’ company among its shareholders. Simultaneously, in the context of

social

media and the Internet, there is an increase in non-wage labour

contributing to

the value of social media companies (Fuchs 2010;

2012; Fisher 2015).

Furthermore,

the company’s commodities

are

situated within a dual relationship between Internet users seeking

information

and content, and information producers seeking users and audiences.

Alphabet

mediates this relationship by producing two main types of commodities,

discussed in the following section.

2.2. Informational Rationality: Commodity Exchange and Value

There is no lack of discussion on how actual commodity exchange occurs in social media companies and how value is created: audience commodity (Fuchs 2010; 2012; Fisher 2015), network surplus value (Pasquinelli 2009; 2015), rent (Rigi and Prey 2015; Rigi 2015), etc. have all been examined. From the vantage point of the rationality debate, different capital accumulation strategies have the same goal – maintaining global dominance and control over humans and nature (Marcuse 1960; 2007/1964). Alphabet’s profit-making rationality separates so-called ‘organic’ from paid search results.[19] Free web search service remains one of the main reasons for the company’s strong grasp over user experience. Such a position helps build consumer trust and legitimacy, while allowing for the accumulation of economic and cultural capital (Hillis, Petit and Jarrett 2013).

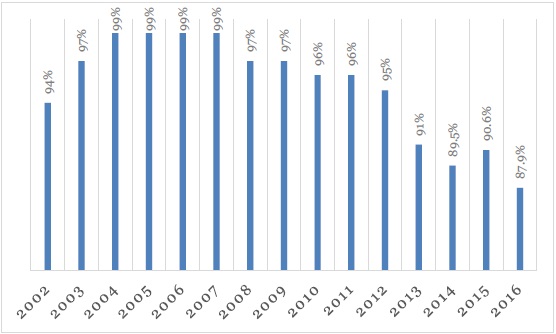

The advertising model is based on what the company calls “performance advertising”: delivering relevant ads that users will click on and engage directly with the advertisers.[20] AdWords[21] is the primary auction-based advertising program, which allows ads to appear on Google services and services of Google Network Members – partner websites and third-party websites across the Internet. Alphabet collects a complex array of information based on search queries, geographic location, language, device (PC, mobile phone, or tablet), and other parameters that may be of interest to advertisers. As the most visited global website[22] with a highly dominant and monopolistic position in the search engine market, the incentive for advertisers to place their ads through the Google system is highly attractive. The largest share of Google’s revenues (Figure 3) comes from advertising. The maintenance of a close relation with users is the main corporate strategy for attracting advertising investments and accumulating capital. The position is evident throughout the history of the company: in the 1998 academic article by Brin and Page, the 2004 IPO letter,[23] the market reports between 2004 and 2016, and in current PR campaigns.[24]

Figure 3: Share of advertising revenue within total revenue (2002-2016). Source: author’s analysis based on Form 10-Ks.

The free service strategy attracts users, while the audience commodity (Fuchs 2012; Fisher 2015) attracts advertisers. This social relationship would not be possible without automated machines that process information input/output. I argue there are two main types of commodities that Alphabet produces: one is the audience commodity for the online advertising market. The company is able to commodify global audiences and trade that information in the digital advertising market. In fact, by offering a global service it controls the prices of digital advertising and attracts the majority of advertising investments worldwide.[25] In 2016, Google held a 71.41% market share of global desktop search and 91.61% of the global mobile and tablet web search.[26] The enormous amount of gathered data is not possible to process without automated algorithms. The second commodity the company produces are algorithms themselves. Yet they are not simply traded on the market as a commodity. Intellectual property rights (IPR) ensure that the web search solution the company developed through R&D investments, acquisitions and other strategies remains the most dominant solution to web search worldwide. IPR ensures the monopoly over algorithmic search services. In July 2017, there were 15,073 patents assigned under the old company name Google, and an additional 18 under the new company name Alphabet.[27] Paid labour of the company’s R&D staff, as well as continuous usage and unpaid labour by Internet users, produce the algorithmic commodity. The audience commodity is profitable through its exchange value in the digital advertising market; the algorithmic commodity is profitable through stock trading and financial capital. The first commodity is the source of control over humans: audiences and their labour. The second commodity is the source of control over IPR which secures the monopolistic position in the search engine market.[28] These two commodities are not exclusive. In fact, one is not profitable without the other, and both require paid and unpaid labour. Profits are ensured through different informational rationalities.

2.3. Algorithmic Machinery: “The Great Vehicle of Reification”

Marcuse (2007/1964, 172) argued that technology becomes “the great vehicle of reification” in advanced industrial societies: “[t]he social position of the individual and his relation to others appear not only to be determined by objective qualities and laws, but these qualities seem to lose their mysterious and uncontrollable character; they appear as calculable manifestations of (scientific) rationality”. Algorithms, engineered calculations and estimates of human needs increasingly determine the relations between humans in algorithmic capitalism. The more people use social media and the Internet, the more metadata of their online presence circulates for surveillance and commodity exchange purposes. Smooth interfaces, and free-of-charge online services blur the awareness of data-gathering practices: “[t]echnology serves to institute new, more effective, and more pleasant forms of social control and social cohesion” (Ibid., xlvi). Reification blurs the consciousness of contradictions embedded in corporate technologies, as well as the relations of production necessary for their maintenance and commodity exchange within the political economy of algorithmic capitalism.

Google’s search engine is dominant worldwide. More usage creates more audience commodities and improves the algorithmic machine. Localisation, languages and geographical barriers are no match for the adaptability and global information control of the algorithm. The machine captures “living time and living labour time and transforms the common intellect into network value” (Pasquinelli 2009). The machine does not produce surplus value but serves to accumulate and augment surplus value based on the exploitation of the general intellect (Pasquinelli 2015). Google’s search algorithm provides and captures information flows and controls relevant information. Moreover, by providing dominant solutions to web search, Alphabet routinises the process of information dependence and steers the development of human needs and capacities. It closes alternatives to the availability of information and situates itself in a position of power to define contemporary social reality. The table below shows what Alphabet values most in terms of searchable web content.

|

March 28 2016 |

March 14 2017 |

|

Shopping or financial transaction pages:

webpages which allow users to make purchases, transfer money,

pay bills, etc. online (such as online stores and online

banking pages). |

Shopping or

financial transaction pages: webpages which allow

users to make purchases, transfer money, pay bills, etc.

online (such as online stores and online banking pages). |

|

Financial information pages:

webpages which provide advice or information about

investments, taxes, retirement planning, home purchase, paying

for college, buying insurance, etc. |

Financial

information pages : webpages which provide advice or

information about investments, taxes, retirement planning,

home purchase, paying for college, buying insurance, etc. |

|

Medical information pages:

webpages which provide advice or information about health,

drugs, specific diseases or conditions, mental health,

nutrition, etc. |

Medical

information pages : webpages which provide advice or

information about health, drugs, specific diseases or

conditions, mental health, nutrition, etc. |

|

Legal information pages:

webpages which provide legal advice or information on topics

such as divorce, child custody, creating a will, becoming a

citizen, etc. |

Legal

information pages : webpages which provide legal advice or

information on topics such as divorce, child custody, creating

a will, becoming a citizen, etc. |

|

Other: there

are many other topics which you may consider YMYL, such as

child adoption, car safety information, etc. |

Other:

there are many other topics which you may consider YMYL, such

as child adoption, car safety information, etc. |

|

|

News

articles or public/official information pages: webpages

which are important for maintaining an informed citizenry,

including information about local/state/national government

processes, people, and laws, disaster response services,

government programs and social services, news about important

topics such as international events, business, politics,

science, and technology. |

Table 1: Changing search quality standards (2016-2017). Source: Search Quality Rating Guidelines (SQRG).

Once produced by in-company workers, Alphabet uses worldwide search quality tests (Bilić 2016) to determine if search algorithms actually find what the company defines as local search relevance and utility. The highest quality standards are set for the so-called Your Money or Your Life (YMYL) websites.[29] The above table shows that Google systematically favours the exchange-value of information. Shopping, financial transactions, financial information pages, health and legal information are a high priority in these guidelines. Businesses running such websites are the ones heavily investing in online advertising, and advertising comprises the bulk of Google’s revenues. Top industries contributing to Internet advertising in 2015 and 2016 were retail, financial services, the automobile industry, the telecom industry, leisure and travel, consumer packaged goods, consumer electronics and computers, pharmacy and healthcare and so on.[30] Such information does have use-value. However, this value is only available through market-related mechanisms of advertising investments, visibility and PR campaigns. The ultimate decision on what is displayed and what is not displayed is left to a single entity – Google. As a monopolistic access point to global information, Google did not formerly have quality standards for improving the use-value of information in a more democratic, plural, equality-related sense. Only after the outbreak of ‘fake news’ in 2016 and the subsequent public outrage did the company introduce “news articles or public/official information pages”.[31] There is a broader use-value of information in contemporary society outside commercial content and the exchange-value of information. The news operates within the market but, ideally, offers positive market externalities in the form of quality content, professional journalistic standards for fostering democratic processes and informed citizenry – issues previously low on the agenda of the information-processing algorithmic machinery of Google. There was simply not enough financial incentive to process such information.

Changes to algorithmic relevance also show the limits of technical solutions for interpreting nuances of human behaviour. Nonetheless, after the breakout of fake news, search engine usage and audience labour transformed the algorithm into a more efficient machine. Algorithms are reified objects in a double sense. First, they hide the labour process necessary for their production. Second, algorithms hide the exchange value of the audience commodity (Fuchs 2012; Fisher 2015) as well as the surplus value accumulation of the exploited labour of the general intellect (Pasquinelli 2009; 2015). The algorithmic machinery becomes a mediating factor between labour, value and surplus value in algorithmic capitalism. In-company labour power and worldwide audience labour produce the audience commodity and the algorithmic commodity, while the algorithmic machine accumulates surplus value for company owners.

3. Pathologies of Algorithmic Capitalism

There is a growing global case for an argument that algorithmic capitalism delivers a 21st-century “pathology of reason” (Honneth 2006). Take, for example, such issues as surveillance, privacy violations, algorithmic bias, fake news, exploitation of paid and unpaid labour, technological unemployment, automated consumerism, commodification of knowledge, energy expenditure of server maintenance, electronic waste, and so on. In a 2017 survey of the “algorithm age”, the Pew Research Centre gathered the opinions of more than 1300 technology experts, scholars, corporate practitioners and government leaders. There were seven main topics cutting across different opinions: algorithms will spread everywhere; good things lie ahead; humanity and human judgment are lost when data and predictive modelling become paramount; biases exist in algorithmically organised systems; algorithmic categorisations deepen divides; unemployment will rise; and the need grows for algorithmic literacy, transparency and oversight.[32]

3.1. Moving Forward

Marcuse’s dialectic[33] position was a critique of corporate and administrative technological rationality from the position of human values, judgment, and liberation. The repressive, one-dimensional, technological rationality can be overthrown by way of the “Great Refusal” – “the protest against that which is” (Marcuse 2007/1964, 66). For Marcuse (2013/1962, 290), humanity implies a certain intelligence to understand and transform the human condition. An individual cannot develop free and autonomous thinking on his/her own: “[t]his is an historical and social responsibility which civilization can, or at least should, carry out against raw nature and against all repressive social and intellectual forces.” Marcuse’s understanding of humanity is a valuable reminder of its ethical and normative ideal. However, we still need concrete steps and ways of promoting such advancements in our socio-historical configuration. Various authors have proposed solutions to deal with corporate accumulation and commodification of information on the Internet and through Google’s search engine: re-appropriating network value (Pasquinelli 2009), expropriating and transforming it into a public, non-profit, non-commercial organisation (Fuchs 2011), and breaking out of core network dynamics by not using such services (Mager 2012).

I argue for a combination of policy, practice and praxis, to alleviate the irrationalities of rationally devised machinery in algorithmic capitalism. First, policy and regulatory responses have been gaining pace. Most prominently, the European Commission opened several anti-trust investigations against Google (Alphabet) because of its dominant position that stifles market competition in the European Economic Area. The European Commission fined Alphabet 2.42 billion EUR in June 2017 for favouring its own comparison-shopping service in its search results.[34] Other investigations are ongoing. All testify to the one-dimensionality of Google’s algorithms and the type of control and dominance they exert. Second, a changed practice of Internet users could have an adverse effect on the corporate behaviour of the company. As shown throughout this paper, Google is heavily reliant on user input for the production of the audience commodity and the algorithmic commodity. Furthermore, scientific practice of computer science and engineering needs to embrace a stronger understanding of social dynamics and human conditions.[35] Finally, the contradictions within algorithmic capitalism need to reach a level of societal consciousness to enable socially and democratically meaningful action. The unity of thinking and doing, the praxis, requires a raised consciousness within the current conditions before any change can be made into a historical reality. The company has essentially been co-funded by the usage labour of the platform, thus creating an unequal distribution of wealth between citizens and company owners. This has been well-established in many critical studies of social media and the Internet. Furthermore, funded by advertising revenue capture from many industries worldwide, the company pauperised the news industry and created a massive gap in the way citizens access trustworthy and democratically meaningful information. The essential step is to use this awareness in order to regain control over key democratic functions of information processing. Without firm control over algorithms, any dissent will be recorded as a glitch in the system. The system will then adapt and the company will become even more efficient. The ultimate goal for praxis is to regain control over algorithms.

4. Conclusion

Drawing on Marcuse (1941; 1960; 2007/1964), algorithms can be conceived as a product of human society and social conditions. In addition, the objectified existence of algorithmic artefacts exerts influence over the behaviour and consciousness of humans. Alphabet’s algorithmic capitalism model is supported by three technological rationalities: the organisational rationality of flexible management values and labour utilisation; the informational rationality of generating value from advertising and audience labour (Smythe 1981; Jhally and Livant 1986); and rationality increasing surplus value, reifying labour and commodity exchange. The company produces two main types of commodities. First, the audience commodity (Fuchs 2010; 2012; Fisher 2015) for the advertising market. Second, the algorithmic machine for the search engine market. Company engineers and Internet users produce the audience commodity and the algorithmic commodity. Reification (Lukács 1972/1923; Marcuse 2007/1964) blurs the consciousness of contradictions embedded in algorithms, as well as the relations of production necessary for their maintenance and commodity exchange in the market. Algorithmic machinery mediates labour, value and surplus value. Company employees and audience labourers produce the audience commodity and the algorithmic machine, while the algorithmic machine accumulates surplus value (Pasquinelli 2009; 2015) for company owners. Reclaiming algorithms under social and democratic control requires a combination of policy, practice and praxis – a raised consciousness of the contradictions and struggles embedded within corporate technologies and a series of steps for gaining control. Algorithms will continue to expand in multiple areas and continue to create struggles and contradictions between human values, judgements and corporate control and dominance. It is important to remember that technologies are not neutral or objective (Marcuse 2009/1965) – they are either good or bad for humanity, depending on who is in control.

References

Boltanski, Luc and Čve Chiapello. 2007. The New Spirit of Capitalism. London: Verso.

Diakopoulos, Nikos. 2014. Algorithmic Accountability: On the Investigation of Black Boxes. Accessed 8 January 2018. http://towcenter.org/research/algorithmic-accountability-on-the-investigation-of-black-boxes-2/#endnotes

Feenberg, Andrew. 1999. Marcuse or Habermas: Two Critiques of Technology. Inquiry 39: 45-70.

Fuchs, Christian. 2011. A

Contribution to

the Critique of the Political Economy of Google. Fast Capitalism 8 (1). Accessed 8 January 2018. https://www.uta.edu/huma/agger/fastcapitalism/8_1/fuchs8_1.html

Horkheimer, Max. 1933. Materialismum und Metaphysik. Zeitschrift für Sozialforschung 2 (1): 1-33.

Marcuse, Herbert. 1969. An Essay on Liberation. Boston: Beacon Press.

Marx, Karl. 2004/1867. Capital, Volume 1. London: Penguin Books.

About the Author

Paško Bilić

Paško Bilić is a Research Associate at the Department for Culture and Communication, Institute for Development and International Relations in Zagreb, Croatia. He worked on research projects funded by the European Commission, COST, Seventh Framework Programme (FP7) and Croatian Science Foundation. He is co-editing the forthcoming book Technologies of Labour and the Politics of Contradiction (Palgrave Macmillan, 2018). His main research interest is a critical analysis of social relations mediated through digital technologies, public policies and markets.